Can you stop debt collectors from harassing and suing?

BY CHARLES PEKOW · AUGUST 9, 2014 ·

Collectors call again and again in the middle of dinner. They call the wrong person. They threaten. They take advantage of the latest technology to embarrass people. Often, they violate the law. Debt collectors will go to all sorts of legal and illegal means to intimidate people who owe or allegedly owe money. Collection has become a multi-billion dollar business, especially in the last few years as the slow economy had caused people to fall behind on payments.

About 30 million Americans were saddled with debt or alleged debt in collection in 2012, averaging about $1,500 according to the Consumer Financial Protection Bureau (CFPB).

Law has fallen behind technology and the extent of the problem.

Realizing this, Congress created CFPB and granted it limited authority to write rules to govern part of the problem under the Dodd-Frank Act in 2010. Four years later, CFPB collected public comments on the problem over the winter. It plans to survey consumers this summer about their experience and knowledge of their rights.

“I used to be harassed by debt collection agency for a debt that was not my own. I used to have a different phone number. I had to change it because I kept on getting calls from a collection agency that were intended for the prior owner of the phone number. It did not matter how much I told them that they were calling the wrong number. I still got calls,” wrote Dylan Tate, a citizen responding to CFPB.

“What amazes me more than anything else is the impossibility of getting a wrongful debt removed from the record. I was a straw man in real estate and the person who stole my identity was arrested, tried and found guilty and sentenced and served time – YET – more than 15 years later I am still receiving calls from debt collectors for forged name documents and statements on my credit report for properties I never owned. How can this be stopped or cleared up?” wrote Gerald Elgert of Silver Spring, Md.

Though the slow economy exacerbated the problem, an improving one may not help. “Debt collection agencies will experience renewed demand,” as people regain ability to pay, Market research firm IBISWorld reported last November.

Medical debt – the largest source of unpaid bills. Medical bills and educational loans are eclipsing the traditional mortgages and auto loans as the fastest growing categories of debt in collection.

But CFPB’s new authority extends to only the largest companies – it estimates its proposed rules would cover about 175 firms. IBISWorld counted 9,599 firms in the business last fall.

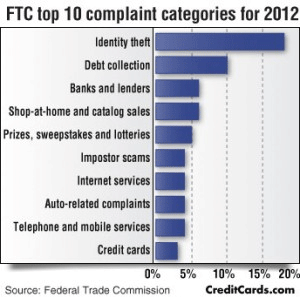

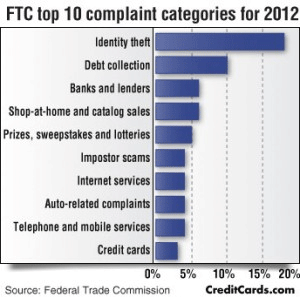

The Federal Trade Commission (FTC) has historically taken the lead role in the issue. The FTC “receives more complaints about debt collection than any other specific industry and these complaints have constituted around 25 percent of the total number of complaints received by the FTC over the past three years,” James Reilly Dolan, acting associate director of the FTC’s Division of Financial Practices said in July Senate testimony. The FTC got 199,721 collection complaints in 2012, up from 142,743 complaints in 2011 and 119,609 in 2009. Almost 40 percent of disputes about national credit reporting agencies concern collection. (FTC figures don’t include other complaints it gets that might include debt collection but it codes as identity theft or do-not-call grievances.)

So who is annoying the most people with repeated phone calls, threats, obscenity and other obnoxious tactics to collect debt? Largely major banks and collection agencies they hire.

In response to a Freedom of Information Act (FOIA) request, the FTC provided a list of the companies getting the most complaints over a 28-month period. They had, by and large, already gotten into legal trouble but that didn’t stop them from continuing to bother people.

- NCO Financial Systems, Inc, a Horsham, PA collection agency (now Expert Global Solutions), with 6,223 complaints. In 2004, NCO paid the FTC $1.5 million, at the time a record debt collection fine. But last July, it broke its own record and paid the largest ever civil penalty in a debt collection case, $3.2 million. “It’s the one we get the most complaints about,” said consumer lawyer Craig Kimmel. Its “dialing system is otherworldly in its sophistication to keep calling people….They will keep calling until somebody pays and people will pay just to get rid of them.” Vaughn’s Summaries, a general reference website, called it “the worst debt collection agency.”

- Allied Interstate, Inc., part of iQor, a privately-owned conglomerate. Allied wracked up 4,934 complaints covering everything from repeated phone calls to falsely representing alleged debts to calling at inappropriate hours. Allied paid $1.75 million in 2010 to the FTC to settle charges of telephone harassment – the second largest fine of its kind at the time. While Citibank, the nation’s third largest bank, doesn’t show up on the list of top violators, that doesn’t mean it’s not profiting from questionable tactics. Another division of parent company Citigroup owns a large stake in iQor. “I draw two conclusions,” stated Sen. Sherrod Brown (D-OH) at a recent Senate hearing. “Citigroup and other banks think debt collection is a lucrative business. There’s a reputational risk to associating with those companies. Citigroup probably does not want their name on an aggressive means so they have iQor or Allied Interstate or something.”

- Portfolio Recovery Associates (PRA) with 4,481 cases, more than 1,000 of them charging callers with failing to identify themselves. The Norfolk, Va.-based company specializes in buying debt, especially of bankrupt people for a fraction of the value and trying to collect the entire sum. PRA is subject to at least five class action and multiple individual suits for alleged wrongdoing such as calling cellphones without permission. PRI denied to us that it breaks laws.

- Capital One Bank, an Allied client, with 3,054 accusations, including calling repeatedly and continuously, at inappropriate times, not sending written notices, refusing to verify debt, and profanity. Kimmel sued Capital One for harassing and demanding almost $287 million from a woman over a debt of less than $4,000.

- Deceptive trade practices and violating a 2009 order. The state charged that the bank continued to “mislead consumers with false promises” that they would not foreclose on homeowners while simultaneously foreclosing. Nevada also charged BofA with a litany of other misrepresentations including “falsely notifying consumers or credit reporting agencies that consumers are in default when they are not.” BofA paid penalties and agreed to change tactics.

- Midland Credit Management (MCM), a national debt buyer that use several names, including Encore Capital Group and Ascension Capital Group, with 1,778. MCM’s parent company reported to the Securities & Exchange Commission that it bought $8.9 billion in credit card debt during the first half of 2012 for about 4 cents on the dollar. The company specializes in suing debtors. MCM paid nearly $1 million in fines to Maryland in 2009 for alleged violation of state and federal laws, including operating without proper licensing. Though CFPB officially opened a complaint line in July about collectors, it got 750 such gripes in the first quarter of 2013, according to information received under FOIA. Consumers complained by far the most about Midland – 44 times, or six percent of the total.

- I.C. System at 1,767, mostly for calling “repeatedly or continuously.” The Minnesota Dept. of Commerce fined I.C. $65,000 for violating a variety of state laws, including failure to screen job applicants properly, hiring felons and not notifying the state that it dismissed at least 10 employees for using profanity. The U.S. Better Business Bureau received 807 complaints about I.C. in the last year.

- Similar name) at 1,644. The company went out of business after five state attorneys general sued it. NCS was acting on behalf of Hollywood Video, the movie rental service that went bankrupt in 2010. NCS was filing negative credit reports on consumers and threatening to sue them if video renters didn’t pay up. The problem stemmed from movie watchers who tried to return videos at stores that closed, said company founder Brett Evans. Though customers followed instructions to leave videos in a bin, their returns weren’t recorded and NCS tried to collect late fees.

- JP Morgan Chase, an NCO client, with 1,522. The Office of the Comptroller of the Currency (OCC) last September issued a Consent Cease and Desist order against Chase for multiple “unsafe and unsound practices” in its collection work, including filing misleading documents in court, not properly notarizing forms and not properly supervising its employees and contractors.

California’s attorney general sued the bank last year for allegedly routinely suing consumers for non-payment without following proper procedures. Unless otherwise noted, the companies either declined to address the charges or did not respond to inquiries. Mark Schiffman, spokesperson for ACA International, the largest collector trade group, said “they’ve made it pretty darn easy to complain in the first place. It’s not fair to say that the (FTC files) are a bellwether, that this is a horrible industry.”

The FTC got one of its largest settlements, $2.8 million, from West Asset Management last year. West didn’t show up on the above list as many people named their creditor, not the collection agency, when complaining. The Omaha, NB-based West agreed not to engage in tactics the FTC accused it of, including calling the same individuals multiple times a day, using “rude and abusive language” and disclosing information to third parties.

But West was making plenty of the calls that led to trouble for the banks. West said on its website that its clients include “seven of the top 10 credit card issuers, and other Fortune 500 companies.” The top five include four of the biggest sources of complaints: Chase, Capital One, Citigroup and BofA, according to Card Hub, an online search tool.

Only 15 lawsuits in nearly four years. It lacks the resources to handle every complaint so it focuses on the most serious abusers or cases that can establish a legal precedent. While CFPB is now taking complaints and can write rules, its small staff won’t be able to make more than another dent in the problem.

An FTC report on the issue said “based on the FTC’s experience, many consumers never file complaints with anyone other than the debt collector itself. Others complain only to the underlying creditor or to enforcement agencies other than the FTC. Some consumers may not be aware that the conduct they have experienced violates (the Fair Debt Collection Practices Act, or FDCPA ). For these reasons, the total number of consumer complaints the FTC receives may understate the extent to which the practices of debt collectors violate the law.”

And much lies out of FTC jurisdiction. FDCPA, for instance, does not apply to banks, on the theory that banks are less likely to annoy their customers than an outside collector. If a bank harasses people, the victims can contact OCC or Federal Deposit Insurance Corporation. But if a bank hires a collection agency, the consumers can go to the FTC. Judging by a look at the FTC complaint database, people are confused. “We do get a lot of complaints” about banks, said Tom Pahl, who served as assistant director of the FTC Bureau of Consumer Protection (BCP) before becoming CFPB’s managing regulatory counsel. William Lund, superintendent of the Maine Bureau of Consumer Credit Protection, said at a CFPB forum that people are so baffled that he gets many complaints from out of state.

What are consumers complaining about? The FTC log said that about half of debtors or alleged debtors simply complained of harassment. Thirty percent said they never even got a required written notice before calls came. A quarter said they got threats of civil or criminal action ranging from garnishing wages to seizing property, harming credit ratings and getting forced out of jobs. And 23 percent said the callers didn’t even identify themselves as debt collectors.

About 16 percent complained of obscenity, eleven percent said collectors were violating the law by calling before 8 am or after 9 pm. and four percent cited threats of violence. Ten percent griped of efforts to collect unauthorized money (interest, late fees, court costs). People also complained about everything from overstating debt, calling at work, continuing to call after getting a written notice not to, and not verifying debt when asked in writing or misrepresenting the law. (Many complaints alleged multiple violations.)

And 22 percent of the complaints regarded collectors bothering third parties, such as an alleged debtor’s family, friends, coworkers, employers and neighbors. By law, collectors may only contact other people to locate an alleged debtor. The FTC reported that collectors “have used misrepresenting as well as harassing and abusive tactics in their communications with third parties, or even have attempted to collect from the third party.”

And when you die, your debt doesn’t die with you and neither do collections. Collectors have often called relatives to ask if they’re the one who opens mail or paid for the funeral. If someone said “yes,” collectors have taken that as proof they’re the ones responsible and then asked about assets. So last year, the FTC decreed that collectors may inquire as to who has been designated the estate executor, and then only communicate with that person – and not try to collect debts before they locate the executor. Estates retain rights to contest claims.

Congress wrote FDCPA in 1977 – when collectors used rotary phones as the chief weapon to annoy people. So nothing in the law stops collectors from sending texts, emails and misleading Facebook friend requests to those they want to collect from. Collectors post messages on social network sites of friends and relatives. At a workshop on the issue, BCP Director David Vladeck said that though “using these communications media to collect debts isn’t by itself necessarily illegal, the potential for harassment or other abusive practices is apparent.”

The law gives the FTC no authority to write rules. The law prohibiting contact before 8 am or after 9 pm was intended to apply to telephones and it’s not clear whether it applies to after-hours email. And FDCPA includes no criminal penalties.

Two years ago, an FTC report stated “neither litigation nor arbitration currently provides adequate protection for consumers. The system for resolving disputes about consumer debt is broken.” Arbitration efforts flopped. Three years ago, the Minnesota Attorney General sued the National Arbitration Forum, citing fraud, deceptive trade practices and false advertising – the forum didn’t tell people of its financial ties to the industry. The forum settled and stopped arbitrating.

Consumers also get confused because of the growing debt buying business. Companies specialize in buying debts usually for between five and ten cents on the dollar, then trying to collect the whole shebang. (The nation’s 19 largest banks sell about $37 billion a year in credit card debt, according to OCC.) So people hear from a company they’ve never heard of claiming they owe money. Almost no one engaged in this practice in 1977 so it’s not clear how FDCPA affects debt buyers. People can pay their original creditor after it sold the debt and think they’ve settled the matter, only to face continued collection efforts from the buyer.

OCC said it is working on guidance and “has raised its expectations for banks” in this regard. “Selling debt to third party debt collectors carries particular compliance, reputational, and operational risks,” OCC said in a statement given in July to Brown adding “it is evident these risks are gaining increasing prominence.” Brown said that “OCC has historically been more friendly to banks than to consumers.”

Kim Phan, a lawyer for debt buyer trade association DBA International, said the organization is working on guidance for the industry.

Collectors do more than call and harass. They sue. The New Economy Project (NEP), a New York community advocacy center, recently released a report stating “debt collection lawsuits — particularly those filed by debt buyers — wreak havoc across New York State, depriving hundreds of thousands of New Yorkers of due process and subjecting them to collection of debts that in all likelihood could never be legally proven.”

In 2011, collectors – mostly buyers – filed 195,105 lawsuits against New Yorkers. Almost two-thirds of the time, plaintiffs win default judgments but seldom win on the merits when cases go to trial, NEP said. “A lot of the debt that we see that’s charge-off by banks is debts that they’ve sold off for pennies on the dollar with very little documentation so the banks aren’t held accountable for that debt and the collectors who are trying to collect…are doing so with very limited information and sometimes don’t have sufficient proof and therefore rely on robosigning and other abusive tactics,” declared Alexis Iwanisziw, NEP research and policy analyst, speaking at a July CFPB forum.

Congress has ignored legislation introduced in recent years to modernize the law. In previous years, senators Charles Schumer (D-NY), Al Franken (D-MN) and Carl Levin (D-MI) conducted hearings and introduced bills but failed to move them. They dropped the issue in the current Congress. Their offices did not respond to inquiries.

Brown, however, examined the issue at a July hearing of his Senate Banking, Housing & Urban Affairs Subcommittee on Financial Institutions and Consumer Protection. Brown said in an interview “I don’t know about a legislative solution” and that recent events gave him “hope we may be able to do something (but) we won’t reopen Dodd-Frank in a major way.”

Collection Complaints Tracked for Full Year

BY DARREN WAGGONER

AUG 20, 2014 2:17am ET Collections & Credit Risk

Complaints against debt collectors filed with the Consumer Financial Protection Bureau edged lower in July compared with June – 3,269 from 3,390, according to data reported Tuesday.

July marks one year since the CFPB began fielding complaints against the collection industry. In July 2013, there were only 901 complaints filed as the CFPB ramped up the program. Those numbers jumped the next month. WebRecon, a data tracking firm based in Grand Rapids, Mich., pulled the data from the CFPB, along with lawsuit totals filed at U.S. district courts.

There were a total of 717 debt collectors complained about in July. Editor’s Note: More information on the types of complaints can be found at the bottom of this story.

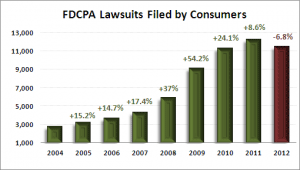

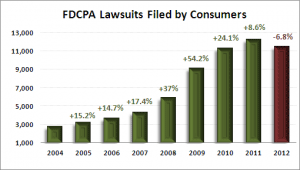

On the statutory front, consumers filed 828 Fair Debt Collection Practices Act lawsuits, of which 9.9% are class actions. Year-to-date, FDCPA lawsuits through July 31 totaled 5,701, down 12.4% from 6,406 filed in July 2013.

Telephone Consumer Protection Act and Fair Credit Reporting Act lawsuits showed some volatility in July compared with July. TCPA cases fell nearly 8% (to 196 from 211) and FCRA lawsuits rose more than 15% (to 202 from 171) from the previous month.

Of the FCRA lawsuits, 21 (10.4%) are class actions. Of the 196 TCPA lawsuits, 19 (9.7%) are class actions.

Year-to-date both TCPA and FCRA lawsuits are significantly higher. TCPA cases are up 33.6% (1,525 compared with 1,012 last year); FCRA cases are up 11.6% (1,376 compared with 1,217 last year).

Some 855 different collection agencies and creditors were sued in July. Of the cases, there were an estimated 1,146 unique plaintiffs. Of the plaintiffs, approximately 365 (or 32%) previously sued under consumer statutes. Combined, those plaintiffs have filed approximately 1,564 lawsuits since 2001.

Attorneys Sergei Lemberg and David Michael Larson were the most active attorneys in July, filing 30 and 25 lawsuits respectively. Lemberg (323 lawsuits) and Larson (162 lawsuits) also top the year-to-date list.

The types of debt behind the complaints were:

• 886 Other (phone, health club, etc.) (27%)

• 712 Unknown (22%)

• 679 Credit card (21%)

• 407 Medical (12%)

• 263 Payday loan (8%)

• 105 Mortgage (3%)

• 87 Auto (3%)

• 74 Non-federal student loan (2%)

• 56 Federal student loan (2%)

The breakdown of complaints:

• 1,347 Continued attempts to collect debt not owed (41%)

• 653 Communication tactics (20%)

• 563 Disclosure verification of debt (17%)

• 268 False statements or representation (8%)

• 239 Taking/threatening an illegal action (7%)

• 199 Improper contact or sharing of info (6%)

The top 10 states complaints were filed from are:

• 441 Complaints: California

• 288 Complaints: Texas

• 254 Complaints: Florida

• 173 Complaints: New York

• 164 Complaints: Georgia

• 138 Complaints: Ohio

• 116 Complaints: New Jersey

• 115 Complaints: Illinois

• 113 Complaints: Pennsylvania

• 106 Complaints: Virginia

The status of the month’s complaints are as follows:

• 2,225 Closed with explanation (68%)

• 573 Closed with non-monetary relief (18%)

• 241 In progress (7%)

• 114 Closed (3%)

• 75 Untimely response (2%)

• 41 Closed with monetary relief (1%)

Consumer Default Rates Fall to 10-Year Low

BY DARREN WAGGONER

AUG 19, 2014 12:30pm ET Collections & Credit Risk

Default rates fell slightly in July to the lowest mark in more than 10 years, according to the S&P/Experian Consumer Credit Default Indices released Tuesday.

The national composite default rate posted 1.01% in July, down one basis point from June. After declining for nine consecutive months, the first mortgage default rate fell to 0.88%. The bank card rate declined 16 basis points to 2.86%.

Auto saw its rate remain unchanged at 0.96% and is only four basis points above its historical low.

“Consumer credit default rates dipped slightly below last month’s rate,” says David M. Blitzer, managing director and chairman of the Index Committee for S&P Dow Jones Indices. “At just above 1%, default rates remain at historical lows. Mortgage default rates have been trending down while auto and bank card are a bit higher than their historical lows set in April and March. Driven by mortgages, household debt decreased in the second quarter of 2014. Non-housing debt rose slightly in the second quarter. In the latest Federal Reserve survey of lending standards, a small portion of banks reported some easing of standards while most banks reported no change.”

Among large cities, Blitzer said Los Angeles dropped to its record lowest default rate of 0.66% and Dallas saw its default rate fall by seven basis points to only a few points away from its historical low set in May.

“Chicago and Miami are at their lowest default rates since 2006. Miami continues to maintain the highest default rate of 1.51% while Los Angeles posted the lowest default rate of 0.66%. All five cities – Chicago, Dallas, Los Angeles, Miami and New York – remain below default rates seen a year ago,” he said.

High-level data through July shows:

• The national composite default rate remains the lowest in over 10 years of history at 1.01%, down one basis point from last month.

• After nine consecutive months of declines, the first mortgage default rate fell to 0.88%.

• Auto saw its rate remain unchanged at 0.96% and is only four basis points above its historical low. Bank card rate declined 16 basis points to 2.86%.

• All five cities – Chicago, Dallas, Los Angeles, Miami and New York – remain below default rates seen a year ago.

• Miami continues to maintain the highest default rate of 1.51% while Los Angeles posted the lowest default rate of 0.66%

• Chicago and Miami are at their lowest default rates since 2006.

Credit Card Late Payment Rate Drops to Seven-Year Low

BY DARREN WAGGONER

AUG 26, 2014 9:42am ET

The rate of credit card payments overdue by at least 90 days dropped to 1.16% in the second quarter ending June 30, the lowest level in at least seven years, TransUnion reported Tuesday.

The report indicates consumers are doing a better job of making timely payments even as lenders extend credit more often to people with troubled credit histories.

The late-payment rate peaked in the first quarter of 2009 at 3.12%, TransUnion officials said. The credit bureau’s data dates to 2007, drawn from information culled from nearly every U.S. consumer who uses credit.

Average card debt per borrower rose slightly in the second quarter, up about 0.2% to $5,234. It increased 1.4% from the first quarter of this year.

The second-quarter credit card delinquency rate is down from 1.27% from the same period last year and 1.37% from the first three months of this year.

Credit card borrowing began rising again in 2011, but the increases have lagged far behind other types of debt, including auto and student loans, according to TransUnion. Overall, U.S. credit card debt has increased 1.3% over the past year, reaching $873.1 billion in June, according to the Federal Reserve.

Lenders are showing more generosity in the amount of credit they extend to cardholders. The average credit limit on new bankcard accounts has risen steadily, up 29.4% to $5,230 over the three-year period ended March 31, TransUnion said. The data lag by a quarter, so those latest TransUnion figures cover the January-March period.

The increase in credit card limits indicates lenders are feeling they can take on more risk while giving consumers a bigger credit cushion, said Tony Guitart, TransUnion’s director of research and consulting.

The number of new credit card accounts opened in the January-March period by consumers rose 17.8% to about 11.7 million versus the same period a year earlier.

The share of cards issued to borrowers with less-than-perfect credit increased to 31.2%, compared with 27.3% a year earlier. That remains far below the roughly 45% share of cards going to non-prime borrowers before the recession.

In the VantageScore credit rating scale, consumers with a score lower than 700 on a scale of 501-990 are considered non-prime borrowers.

Debt Collection Litigation & CFPB Complaint Statistics, July 2014

Quick analysis: July is a milestone month for CFPB complaints against debt collectors, if only because we have reached the one-year mark for complaint reporting and can begin benchmarking year-over-year comparisons.

Having said that, month #1 for CFPB complaints against debt collectors (July 2013) was pretty tame with only 901 complaints filed – a number that we all know dramatically rises in the months to follow it.

July 2014 saw a strong 3269 complaints filed, though that was down a bit from the previous month with 3390 complaints filed in June (up from the reported 3336 a month ago)

On to the statutory horse race, We saw a second straight month of FDCPA gains, but the overall rate is still down double-digits YTD, at 12.4% below 2013.

FCRA and TCPA both showed a bit of volatility last month, with FCRA up over 15% and TCPA down almost 8% from July. Both are still significantly up YTD though, FCRA at 11.6% and TCPA up 33.6% over 2013.

Of the 828 FDCPA cases filed, 82 (9.9%) of them are class actions. Of the 202 FCRA lawsuits filed, 21 (10.4%) are class actions. And of the 196 TCPA lawsuits filed, 19 (9.7%) are class actions.

Finally, 32% of the consumers who filed litigation in July are considered repeat filers, having filed similar litigation in the past.

| Comparisons: |

Current Period: |

Previous Period: |

Previous Year Comp: |

| Jul 01 – 31, 2014 |

Jun 01 – 30, 2014 |

Jul 01 – 31, 2013 |

| CFPB Complaints |

3269 |

3390 |

-3.7% |

901 |

-262.8% |

| FDCPA lawsuits |

828 |

815 |

1.6% |

886 |

-7.0% |

| FCRA lawsuits |

202 |

171 |

15.3% |

176 |

12.9% |

| TCPA lawsuits |

196 |

211 |

-7.7% |

143 |

27.0% |

| YTD CFPB Complaints |

23794 |

901 |

96.2% |

| YTD FDCPA lawsuits |

5701 |

6406 |

-12.4% |

| YTD FCRA lawsuits |

1376 |

1217 |

11.6% |

| YTD TCPA lawsuits |

1525 |

1012 |

33.6% |

Complaint Statistics:

3269 consumers filed CFPB complaints against debt collectors and about 1146 consumers filed lawsuits under consumer statutes in Jul 2014. Here is an approximate breakdown:

- 3269 CFPB Complaints

- 828 FDCPA

- 196 TCPA

- 202 FCRA

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1146 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 365, or (32%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 1564 lawsuits since 2001

- Actions were filed in 160 different US District Court branches.

- About 855 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 74 Lawsuits: Illinois Northern District Court – Chicago

- 56 Lawsuits: Pennsylvania Eastern District Court – Philadelphia

- 46 Lawsuits: Colorado District Court – Denver

- 44 Lawsuits: California Central District Court – Los Angeles

- 33 Lawsuits: California Southern District Court – San Diego

- 33 Lawsuits: New York Eastern District Court – Brooklyn

- 31 Lawsuits: Michigan Eastern District Court – Detroit

- 26 Lawsuits: Georgia Northern District Court – Atlanta

- 25 Lawsuits: Florida Middle District Court – Tampa

- 22 Lawsuits: Florida Southern District Court – Fort Lauderdale

The most active consumer attorneys were:

- Representing 30 Consumers: SERGEI LEMBERG

- Representing 25 Consumers: DAVID MICHAEL LARSON

- Representing 23 Consumers: TODD M FRIEDMAN

- Representing 20 Consumers: KRISTINA N KASTL

- Representing 20 Consumers: VICKI PIONTEK

- Representing 20 Consumers: MICHAEL P DOYLE

- Representing 20 Consumers: PATRICK M DENNIS

- Representing 19 Consumers: CRAIG THOR KIMMEL

- Representing 17 Consumers: ANGIE K ROBERTSON

- Representing 17 Consumers: DAVID J PHILIPPS

Statistics Year to Date:

7401 total lawsuits for 2014, including:

- 5701 FDCPA

- 1376 FCRA

- 1525 TCPA

Number of Unique Plaintiffs for 2014: 7335 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 323 Consumers: SERGEI LEMBERG

- Representing 162 Consumers: DAVID MICHAEL LARSON

- Representing 116 Consumers: JOHN THOMAS STEINKAMP

- Representing 112 Consumers: TODD M FRIEDMAN

- Representing 107 Consumers: MICHAEL ANTHONY EADES

- Representing 104 Consumers: ADAM JON FISHBEIN

- Representing 103 Consumers: DAVID J PHILIPPS

- Representing 100 Consumers: ANGIE K ROBERTSON

- Representing 85 Consumers: CRAIG THOR KIMMEL

- Representing 80 Consumers: MARY ELIZABETH PHILIPPS

——————————————————————————————————-

CFPB Complaint Statistics:

There were 3269 complaints filed against debt collectors in Jul 2014.

Total number of debt collectors complained about: 717

The types of debt behind the complaints were:

- 886 Other (phone, health club, etc.) (27%)

- 712 Unknown (22%)

- 679 Credit card (21%)

- 407 Medical (12%)

- 263 Payday loan (8%)

- 105 Mortgage (3%)

- 87 Auto (3%)

- 74 Non-federal student loan (2%)

- 56 Federal student loan (2%)

Here is a breakdown of complaints:

- 1347 Cont’d attempts collect debt not owed (41%)

- 653 Communication tactics (20%)

- 563 Disclosure verification of debt (17%)

- 268 False statements or representation (8%)

- 239 Taking/threatening an illegal action (7%)

- 199 Improper contact or sharing of info (6%)

The top five subissues were:

- 829 Debt is not mine (25%)

- 405 Debt was paid (12%)

- 396 Not given enough info to verify debt (12%)

- 385 Frequent or repeated calls (12%)

- 209 Attempted to collect wrong amount (6%)

The top states complaints were filed from are:

- 441 Complaints: CA

- 288 Complaints: TX

- 254 Complaints: FL

- 173 Complaints: NY

- 164 Complaints: GA

- 138 Complaints: OH

- 116 Complaints: NJ

- 115 Complaints: IL

- 113 Complaints: PA

- 106 Complaints: VA

The status of the month’s complaints are as follows:

- 2225 Closed with explanation (68%)

- 573 Closed with non-monetary relief (18%)

- 241 In progress (7%)

- 114 Closed (3%)

- 75 Untimely response (2%)

- 41 Closed with monetary relief (1%)

This includes 3132 (96%) timely responses to complaints, and 137 (4%) untimely responses.

Of the company responses, consumers accepted 0 (0%) of them, disputed 414 (13%) of them, and 2855 (87%) were N\A.

The top five days for complaints were:

- 174 Complaints: Mon, 07/07/2014

- 158 Complaints: Thu, 07/10/2014

- 157 Complaints: Thu, 07/24/2014

- 156 Complaints: Mon, 07/14/2014

- 155 Complaints: Wed, 07/09/2014

Fed Survey Reviews Consumer Debt Trends

BY DARREN WAGGONER

SEP 5, 2014 2:30pm ET

The income gap between wealthy and average consumers in the U.S. is growing while overall debt held by consumers dropped, according to the Federal Reserve’s September survey on consumer finances.

The Fed reports that interest rates on most types of consumer debt, along with families’ overall debt, decreased between 2010 and 2013. Much of the decline in debt can be explained by a large drop in the fraction of families with home-secured debt, down from 47% to 42.9%. This is, in part, explained by the much smaller drop in homeownership from 2010 to 2013.

Overall, debt obligations fell in the three-year period, according to the Fed. Median debt is down 20%, and mean debt dropped 13% for families with debt.

The percentage of families with credit card debt also declined. Median and mean balances for families with credit card debt declined 18% and 25%, respectively, and the amount of families that pay their complete credit card balances every month has increased.

Contrary to other forms of debt measured in the survey, education debt increased significantly between 2010 and 2013.

The survey compared information about family incomes, net worth, credit use and other financial resources. Nationwide, the Fed reports that the real gross domestic product increased at an annual rate of 2.1% from 2010 to 2013 and the unemployment rate fell from 9.9% from 7.5%.

“Although aggregate economic performance improved substantially relative to the period between 2007 and 2010 surveys, the effect on incomes for different types of families was far from uniform,” according to the Fed.

In the three-year period, the overall average family income rose 4% in real terms, but median income dropped 5%, consistent with rising income concentration during the period.

In 2013, medical debt (hospitals, physician groups and clinics) ranked as the largest debt category in the U.S., accounting for nearly 38% of all debt collected. Student loan debt trailed medical debt with more than a quarter of all debt collected, followed by credit card debt (approximately 10% of the total), according to findings from a survey by ACA International and Ernst & Young.

Third-party debt collectors recovered $55.2 billion last year for creditor and government clients, returning an estimated $45 billion to them and keeping some $10.4 billion in commission and fees.

The survey showed that the health of national and state economies relies on the recovery of consumer debt, according to ACA, the largest association for collection agencies. It also indicates that only a small percentage of outstanding consumer debt actually was recovered in 2013. Ernst & Young surveyed an estimated 300 collection agencies and used public data from the U.S. Census and The North American Industry Classification System.

Half A Million More Americans Are In Default On Their Student Loans Than A Year Ago

BY ALAN PYKE POSTED ON AUGUST 6, 2014 AT 3:15 PM

The default rate on federal student loans has risen by about 5 percent in the past year and 500,000 more borrowers have slipped into default, according to new statistics from the Department of Education (DOE). More than one in eight total outstanding loans is in default, and more than one in five borrowers who should actually be repaying their loans are a year or more behind.

The overall default rate on taxpayer-funded student loans rose from 12.8 percent to 13.5 percent over the past year, the new data show. The effective default rate, which can be calculated by removing loans to students who are still in school or otherwise not expected to be making payments at this time, rose from 21.2 percent to 21.9 percent. The majority of defaulted loans come from a defunct lending system known as FFEL that used private banks as middle men in lending to students. But because that program was shut down in 2010, all of the increase in defaults comes from the DOE’s direct loan program. The number of direct loan recipients in default rose from 2.1 million to 2.5 million over the past year, the data show.

The same data release shows an encouraging jump in enrollment in federal programs that let workers repay their student loans more gradually. The number of borrowers using income-based repayment (IBR) programs such as Pay-As-You-Earn has doubled in the past year, reflecting a push to publicize the programs by the Obama administration. But while 10.5 percent of borrowers who are actively repaying their loans are now enrolled in one of these programs that links monthly payments to monthly earnings, there is substantial reason to think that the programs remain under-enrolled. Defaults still outnumber IBR enrollees by more than three-and-a-half to one.

“We know that the rising cost of higher education and growing levels of student debt hit home for millions of Americans,” DOE Assistant Press Secretary Denise Horn said in an email. “In addition to expanding income-based repayment options and reaching out to struggling borrowers to make them aware of the flexible options available to repay their debt, the Department has also created tools such as the College Scorecard and Financial Aid Shopping Sheet so that students and families can understand their options and choose the college that provides them with the best value. In addition, we are also focusing on keeping college costs down by developing a college ratings system that will push innovations and systems changes that will benefit students and families.”

Numerous other policy proposals could help address the broken college financing system for future generations and cancel out some of the race and class advantages that tilt the educational playing field. The simplest would be to pay for every American to go to public universities — an idea that may seem starry-eyed but which would cost less than what the government spends now on the current system of college subsidies. Sen. Elizabeth Warren (D-MA) has proposed slashing student loan interest rates dramatically. Other, less radical approaches to financing higher education for future Americans include small savings accounts that have been proven to drastically increase a kid’s chances of getting to college.

But those forward-looking solutions wouldn’t necessarily do much for those who the system is failing today. The generation that owes more than a trillion dollars in student loans today and is defaulting at higher and higher rates need more immediate solutions.

What’s more, rising default rates are only part of the picture. Millions more student loan borrowers are delinquent on their loans, meaning they are 90 days behind on payments but not yet in default. The official delinquency rate vastly understates the real shape of delinquencies, according to a Federal Reserve Bank of New York study published in April.

The “effective delinquency rate” calculated in that study intentionally excludes those still in school, in post-graduation “grace periods,” and graduates enrolled in IBR programs. By ruling out those categories of borrowers who are not expected to be actively reducing their outstanding loan balances, the effective delinquency rate provides a more accurate picture of the success or failure of graduates who should be paying down their loans if the system is functioning properly. The study’s findings indicate that the system is badly broken: Over 30 percent of borrowers who should be repaying their loans are delinquent, as compared to the 17 percent delinquency rate shown in official data.

The Fed data includes private loans as well as those charted by the newly-released federal numbers, so trying to draw direct comparisons to the new default and IBR statistics for taxpayer-funded loans would be tricky. But taken together, the 30 percent effective delinquency rate overall and the rising default rate reported by the DOE illustrate that the system by which people who borrow to finance their educations are supposed to be able to climb out of debt is not working for a very large and growing share of Americans.

The debt overhang those borrowers face doesn’t only hurt them. The student loan crisis is also preventing millions of people from buying houses and cars and cell phones. The economy as a whole would benefit from taking some of the pressure off of these graduates.

One idea proposed by Center for American Progress experts is to start enrolling students in IBR programs automatically rather than waiting for the programs to continue their steady, gradual progress. Another is to set up a public-private partnership between the federal government and banks that would refinance existing loans at more affordable rates and even forgive some of the outstanding principal.

But the most immediate relief that lawmakers could offer to the 7 million people currently in default on their loans might be to let them declare bankruptcy. Years of legal maneuvering by debt collections companies has made it impossible to discharge student loan debt in bankruptcy, making educational debt more dangerous than credit card debt, mortgage debt, and most other forms of borrowing. If lawmakers restored borrowers’ ability to restructure or eliminate student debt in bankruptcy, they could unleash trillions of dollars in pent-up consumer spending that might reinvigorate the economic recovery.

LENDERS TARGET UNDERBANKED

By PYMNTS

7:00 AM EDT July 28th, 2014

According to a new survey by KPMG LLP, nearly a quarter of bankers believe that “underbanked” customers—those who use only basic checking services—represent the biggest growth opportunity for their firms. This result nearly doubles results from one year ago, when only 12 percent of bankers polled reported such enthusiasm for underbanked customers, reports The Wall Street Journal.

Underbanked consumers consist of young banking service users, such as high school and college students or recent grads, and low-income customers with limited access to credit. Around 10 million U.S. households are entirely unbanked, while around 24 million (20.1 percent) are underbanked, according to data from the FDIC.

Underbanked customers spend more money on fees than average doing standard features such as cashing checks or using ATMs.

“Banks are getting more creative and thoughtful about how they target unbanked and underbanked customers,” said Judd Caplain, KPMG’s Advisory Industry Leader for Banking and Diversified Financials, reports The Journal.

Caplian also noted that banks hope to bridge the gap between themselves and this consumer segment by attempting to customize and make more widely accessible product offerings.

Consumer Behavior

A Culture of Unaccountability Regarding Consumer Debt

Joann Needleman August 12, 2014 Inside ARM

The recent report issued by the Urban Institute and the Consumer Credit Research Institute titled Delinquent Debt in America (July 2014) made a stunning statement about the American consumer’s financial health: over 35 percent of the U.S. population has at least one debt account in third-party collections.

The major media outlets reported only that one-third of Americans are in debt. The blogosphere and viral comments were equally bland: no commentary, no analysis, just “it is what it is.” The lead article in one online publication stated, “Americans Are Really Terrible at Paying Their Bills.” Nonetheless, despite a great title, the only conclusion drawn by the author was that more regulation was needed.

Welcome to the Culture of Unaccountability. There are approximately 318 million people in the United States and 75 to 100 million of them have completely refused to communicate with their original lender or to the entity to which they may owe money. This Urban Institute Report was not about whether the debts were legitimate or not, but rather that 35 percent of the U.S. population is not doing anything about the debts they owe.

The intent of the report was certainly not to criticize those who happen to get into debt in the first place. Nor did it offer solutions to foster financial responsibility. However, whether intentional or not, what this report does show is that burying one’s head in the sand has become socially acceptable.

A Need for Communication

Turning over an account to a third-party debt collector or even to a collection attorney is not the preferable choice of any originator, lender or creditor; quite the opposite. The decision to depart with an account where money is owed, and outsource it to another third party to collect, rests in no small part on the fact that the consumer refuses to communicate in order to resolve the account. The creditor is now resigned to the fact that it will not recover what the debtor promised to pay.

The level of communication between debtor and creditor certainly does not increase once the delinquent debt is handed over to a third party. The National Association of Retail Collection Attorneys reports that continued failure to communicate as well as increased barriers to communication make it 81 percent more likely that a consumer ultimately will be sued for the debt.

This Urban Institute data really comes as no surprise. The advent of enhanced debt collection regulation and with more federal rules coming soon, federal regulators have vowed to protect, and impliedly encourage, this growing trend of financial “moral hazard.”

Last year the CFPB issued “action letters,” providing consumers with a plan to shut down communications with creditors, regardless of whether the debt was valid. Last month a New York state judge suggested it might be OK not to come to court if served with a summons on a debt collection case. Fostering a culture that encourages and rewards broken financial promises may be among the reasons we have experienced a weakened economy, feeble growth in employment and restrictive access to credit for many Americans.

Encourage Resolving Delinquent Debt

Creditors, collection agencies and collection attorneys are ready, willing and able to work with consumers to resolve their debts. But doing so requires dialogue between creditors and debtors. Shutting down communication and avoiding difficult, but solvable financial problems is not a solution. Recent comments by the ACA International found that as much as 99 percent of all debt in collection is not disputed by consumers, a fact the Urban Institute and the Consumer Credit Research Institute report did not point out. The overwhelming majority of delinquent debts are ripe for resolution.

Addressing the problem of delinquent debt can be difficult. But resolving poor finances benefits consumers, creditors and the nation’s well-being. Encouraging 35 percent of the population to stick their heads in the sand when it comes to their credit future is not consumer protection – it is a recipe for financial distress. Fostering this culture of unaccountability will likely leave consumers with a weakened, if not irreparable financial future. An America where thirty-five percent of our neighbors suffer long-term financial distress is a far greater harm than the alleged problems posed by the debt collection industry.

learn2comply’s Fractional Compliance Professionals give you the heft and breadth of a compliance professional on your team, a consistent voice at the leadership table, and the peace of mind of not having to carry a large financial burden.

learn2comply’s Fractional Compliance Professionals give you the heft and breadth of a compliance professional on your team, a consistent voice at the leadership table, and the peace of mind of not having to carry a large financial burden.